Co-pay card adjustment programs: How do they affect patients, payers, and pharma?

“Co-pay cards” (or “co-pay coupons”) are financial assistance programs from drug manufacturers (pharma) that drastically reduce the out-of-pocket (OOP) costs for someone who needs an expensive medication. These programs are controversial:

“Co-pay cards” (or “co-pay coupons”) are financial assistance programs from drug manufacturers (pharma) that drastically reduce the out-of-pocket (OOP) costs for someone who needs an expensive medication. These programs are controversial:

-

- Pharma and patients believe that these programs allow sick people to afford the medications they need.

- Healthcare payers (ie, insurance companies or their pharmacy benefit managers [PBMs]), however, regard such programs as schemes that circumvent their cost-management techniques (such as formulary tiers and patient cost-sharing). This is because with no financial impact from OOP costs, doctors and patients could decide to use more expensive drugs than the ones preferred by the insurance plans (eg, generic or well-established branded drugs).

Because of these opposing points of view, payers have tried (with limited success) to disallow co-pay cards if possible, and pharma is developing new ways to circumvent payer controls. This “cat-and-mouse” game has antagonized payer-pharma relationships as each are pursuing different goals: payers are trying to manage expensive medication use, whereas pharma is trying to maximize their sales and prescription volumes.

Now, payers are rolling out new co-pay card adjustment programs that can identify the use of a co-pay card, reallocate its monetary value, and restore drug spending controls and cost-sharing. Though these programs have many different names, they are being implemented by various large payers such as United Healthcare, various Blue Cross and Blue Shield companies, CVS Caremark, and Express Scripts.

But first, how do co-pay cards traditionally work?

To better understand how these cards work, let’s look at an example:

1. Mr. Smith needs an immune-suppressing drug that costs $5,000 a month

2. His insurance plan (provided through his employer) has

a. An annual deductible of $2,500

b. An OOP maximum of $5,000

c. 25% co-insurance for the drug (he is responsible for 25% of the drug’s costs after the $2,500 deductible until he reaches his $5,000 OOP maximum)

3. He is eligible for a manufacturer co-pay assistance program that has a $0 co-pay, covers his OOP responsibility, and provides a total annual benefit of $10,000

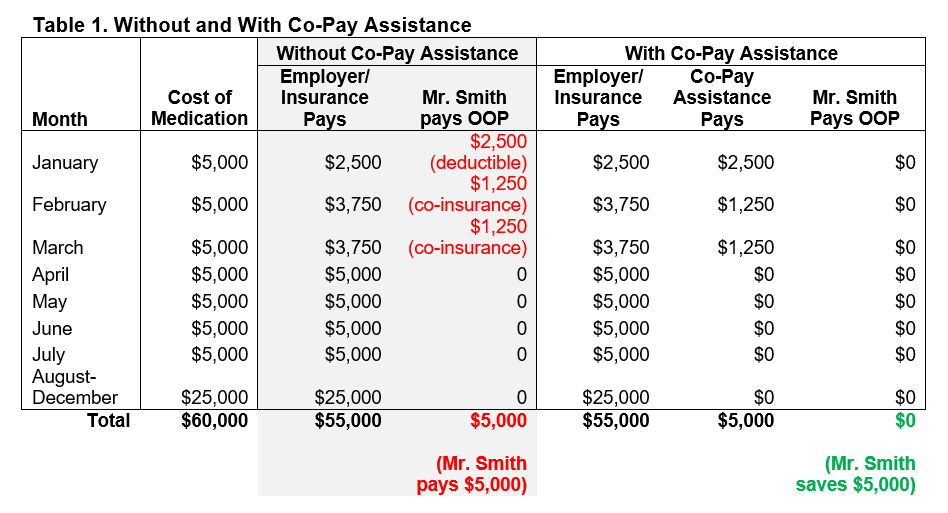

As we can see in Table 1, without any co-pay assistance, Mr. Smith will have to pay his full $5,000 OOP maximum in the first 3 months of the year, but then his employer/insurance will cover the cost of the drug for the rest of the year. If he cannot afford to pay $5,000 in the first 3 months of the year, he may have to stop using the medication or consult with his doctor to use a less-expensive drug. If he is able to use the manufacturer’s co-pay assistance program, however, Mr. Smith will have $0 OOP costs for the entire year and there are no financial barriers to using the medication. For Mr. Smith, and many patients using co-pay cards, he is receiving a dual benefit—not only alleviation of the drug co-pay but also fulfillment of his OOP maximum such that his insurance company will pick up more of the costs of any additional medical treatments throughout the year.

How are payers striking back at co-pay cards?

For many years, co-pay card usage was hard to track because patients could use any pharmacy to obtain their medications and because coupon information was not readily shared between the pharmacies and payers. This is no longer the case due to changes in policy and information-sharing technology.

Now, many payers require patients to obtain expensive medications from in-network, specialty pharmacies, often via mail-order channels. When these pharmacies receive a patient’s co-pay card, they can inform the insurance company (or PBM) that a coupon is being used. Payers can now implement a co-pay card adjustment program: a series of procedures that adjusts for the use of a co-pay card. With the information from the specialty pharmacy, the insurance company/PBM can divert the value of the coupon such that it does not count towards the patient’s OOP maximum. This shift has been increasing in the past year, and it results in new cost surprises for patients.

To better understand this, let’s return to our example:

1. Mr. Smith needs an immune-suppressing drug that costs $5,000 a month

2. His insurance plan (provided through his employer) has

a. An annual deductible of $2,500

b. An OOP maximum of $5,000

c. 25% co-insurance for the drug (he is responsible for 25% of the drug’s costs after the $2,500 deductible until he reaches his $5,000 OOP maximum)

d. A requirement that all expensive medications be ordered through in-network specialty pharmacies

e. A co-pay card adjustment program

3. He is eligible for a manufacturer co-pay assistance program that has a $0 co-pay, covers his OOP responsibility, and provides a total annual benefit of $10,000

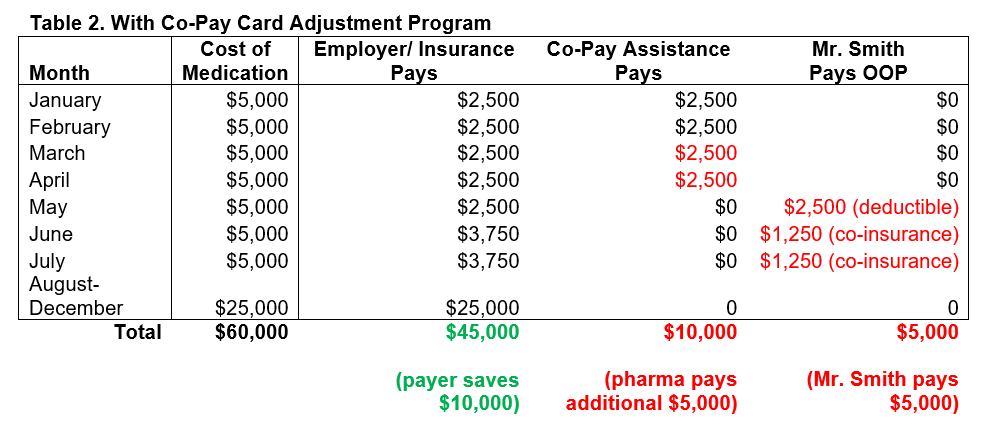

As we can see in Table 2, Mr. Smith still pays nothing OOP for the first 4 months of the year due to co-pay assistance. However, because of the co-pay card adjustment program, the co-pay card value does not count towards his OOP limit. Thus, in May the co-pay assistance total benefit of $10,000 will be met and Mr. Smith will need to start paying his deductible and co-insurance. As with the previous example above, Mr. Smith may have to make hard decisions about this medication if these OOP costs are a severe financial burden. For the payers, this actually results in his insurance plan/employer saving money over the course of the year.

What is the potential impact?

Co-pay card adjustment programs are the latest response by payers in this cat-and-mouse game. These programs restore patient cost-sharing and could save money for payers, but may also result in patient adherence issues or use of less-effective treatments, both of which could increase the likelihood of doctor visits and/or hospitalizations. Adherence issues will likely be more severe for diseases that have no low-cost alternatives and require the use of expensive biologics or advanced treatments. Pharmaceutical manufacturers will be affected by reduced prescription volumes and sales, impacting their revenues and R&D investments. Reduced prescription volumes could also drive prices up as companies seek to maintain their earnings against lower demand.

These new co-pay card adjustment programs will likely spur some manufacturers to create new co-pay assistance approaches that will circumvent these new programs. But to what end and how will this further inflame pharma/payer relationships? What’s needed are long-term solutions that balance access and patient financial assistance.

What are possible solutions?

While some would claim that third-party foundations are the answer, we believe that given recent legal investigations, these are not a sustainable long-term solution. The provaluate team has thought of several innovative solutions for co-pay assistance that does not antagonize the relationship between payers and pharmaceutical companies. Here are just a few:

- Allow traditional co-pay assistance for drugs/formulary tiers with no less-expensive alternatives

- For some diseases, the most effective medications are expensive specialty drugs because no alternatives exist. For these diseases, payers could allow the traditional co-pay card model (ie, counting toward patient OOP maximum) to provide some financial assistance to patients who need these expensive drugs. This would be relatively easy to adjust through current information systems

- Payer-pharma co-pay support partnership

- Similar to risk-sharing pricing agreements, payers and pharma could partner to develop co-pay assistance agreements. A cost-sharing program could be developed where payers and pharma offer co-pay assistance for patients with proven medical need and, if these patients do not benefit from the drug, pharma could provide additional rebates that consider the loss of patient OOP contributions. In this way, patients benefit from the co-pay assistance that counts towards their OOP maximum and yet payers will see no budget impact

- Payer-driven assistance programs

- Payers could create their own stand-alone patient-support programs where patients could apply for financial assistance through their insurance. Payers are in the unique position to access patient records and investigate whether a patient is medically qualified for an expensive therapy. This, combined with an application process to identify financial need, could result in a support program that targets medically necessary cases

These are only some of the solutions that the provaluate team can offer regarding co-pay card adjustment programs. To learn more about what we can offer as strategic partners in market access, please contact Scott Roberts ([email protected]).

Kenneth Ng, PhD, MSCTI, is an accomplished scientist and healthcare marketer with years of experience across HCP, patient, and payer healthcare marketing. His current passion is helping clients navigate the increasingly complicated market access terrain, including value proposition development, buy-and-bill, and patient access support. Connect with Kenneth on LinkedIn.

Kenneth Ng, PhD, MSCTI, is an accomplished scientist and healthcare marketer with years of experience across HCP, patient, and payer healthcare marketing. His current passion is helping clients navigate the increasingly complicated market access terrain, including value proposition development, buy-and-bill, and patient access support. Connect with Kenneth on LinkedIn.